Introduction

Definition of Bookkeeping

Bookkeeping can be defined as the methodical recording and organizing of financial transactions. It involves tracking every penny that comes in and goes out, ensuring that the books are balanced and accurate. This practice forms the backbone of any successful business, allowing owners to have a clear picture of their financial health.

Importance of Bookkeeping

The importance of bookkeeping cannot be overstated. It serves several vital functions, including:

- Financial Clarity: Bookkeeping provides a clear understanding of the metrics that matter, like cash flow and profits.

- Tax Compliance: Accurate records ensure that businesses meet their tax obligations smoothly.

- Informed Decision-Making: With reliable data at their fingertips, business owners can make informed decisions regarding growth and investment.

Consider a small café owner who meticulously maintains their financial records; not only do they avoid low cash flow surprises, but they also gain insights into popular menu items. In contrast, a café with poor bookkeeping might struggle with unexpected expenses and losses. Clearly, effective bookkeeping is key to navigating the financial landscape of any business.

Fundamentals of Bookkeeping

Double-Entry System

At the heart of effective bookkeeping lies the double-entry system. This method requires that each financial transaction affects at least two accounts, ensuring that the accounting equation (Assets = Liabilities + Equity) always stays in balance.

For example, when a business purchases new equipment for $1,000, it not only increases its assets but also creates a liability or reduces cash by the same amount. This system promotes accuracy and provides a comprehensive view of financial activity, and it’s the reason why accountants often say, “Every debit has a corresponding credit.”

Debits and Credits

Understanding debits and credits is essential for any bookkeeping system.

- Debits increase asset and expense accounts, while decreasing liability, equity, and revenue accounts.

- Credits, on the other hand, do the opposite—decreasing assets and expenses but increasing liabilities, equity, and revenue.

This balance of debits and credits is crucial. For instance, a business selling a product will record a debit to cash and a credit to sales revenue, maintaining that delicate balance. Once mastered, these concepts enable business owners to ensure their financial records are accurate and tell a compelling story about their financial health.

Types of Bookkeeping

Single-Entry Bookkeeping

When it comes to bookkeeping methods, single-entry bookkeeping is often the simplest. This approach primarily records cash transactions and is typically used by smaller businesses or sole proprietors.

- Key Characteristics:

- Records only income and expenses.

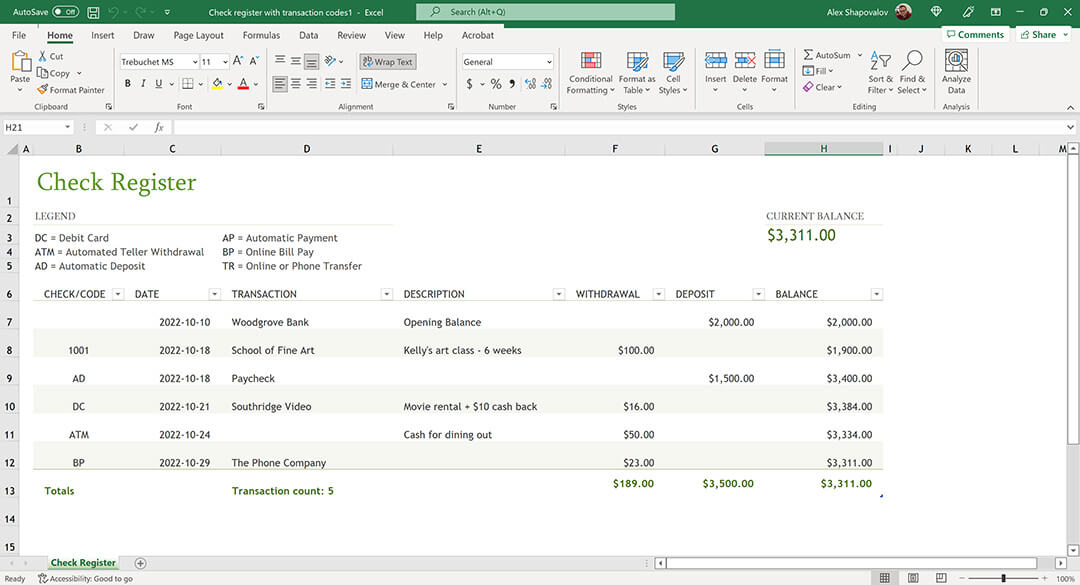

- Maintains a check register or cash book.

- Easier to use for individuals with basic accounting knowledge.

For example, imagine a freelance graphic designer keeping track of client payments and expenses for software. Using a single-entry system, they’d simply log incoming payments and outgoing costs without needing to manage complex balancing.

However, this simplicity comes with a trade-off: limited insights into financial status and no built-in checks for errors.

Double-Entry Bookkeeping

In contrast, double-entry bookkeeping is the gold standard for businesses of all sizes. As previously mentioned, it emphasizes maintaining a balance in accounts by recording every transaction with both a debit and a credit.

- Key Characteristics:

- Provides a complete financial picture.

- Used by medium to large enterprises.

- Enhances accuracy and accountability in financial records.

Consider a small retail store that tracks sales and expenses. By using double-entry bookkeeping, the owner can see detailed reports on cash flow, inventory, and profits. This not only aids in decision-making but also simplifies tax preparations, making it a robust choice for serious business operations.

Bookkeeping Process

Recording Transactions

The next step in the bookkeeping process is the meticulous recording of transactions. This crucial step involves documenting every financial event in a timely manner, ensuring nothing slips through the cracks.

- Methods of Recording:

- Manual Journals: Write transactions by hand in simple ledgers.

- Digital Tools: Utilize software systems that automate data entry and organization.

For instance, a small bakery may log daily sales and supplier purchases. By recording these transactions daily or weekly, they maintain an accurate depiction of cash flow and avoid year-end scramble sessions.

Balancing the Books

Once transactions are recorded, the next phase is balancing the books. This ensures that total debits equal total credits, confirming the accuracy of entries.

- How to Balance:

- Regularly reconcile bank statements with bookkeeping records.

- Conduct monthly reviews to identify discrepancies.

Balancing the books can feel like the financial equivalent of putting together a puzzle. The owner of that same bakery regularly checks their ledgers against bank statements, catching any missing entries. When all financial pieces align, it not only boosts confidence but also enhances financial decision-making moving forward.

Bookkeeping Tools and Software

Manual Bookkeeping Systems

While we’re living in a digital age, many businesses still rely on manual bookkeeping systems. This traditional method involves using physical ledgers, journals, and calculators to track financial data.

- Benefits of Manual Systems:

- Simplicity: Easy to set up without needing advanced tech skills.

- Tactile Learning: Physically writing entries can help some individuals better understand their finances.

For example, a local artist might use a simple notebook to keep track of sales and expenses. This hands-on approach allows them to feel connected to their finances, though it might get cumbersome as transactions increase.

Digital Bookkeeping Tools

In contrast, digital bookkeeping tools have revolutionized how businesses manage their finances.

- Popular Options:

- QuickBooks: Robust software for small to medium-sized businesses.

- Xero: Ideal for real-time collaboration with accountants.

- FreshBooks: Tailored for freelancers and service-based businesses.

These tools streamline the bookkeeping process with features like automatic transaction syncing and reporting capabilities. For instance, a small cafe using QuickBooks can easily generate sales reports and track inventory. By embracing digital solutions, business owners not only save time but also gain valuable insights that manual systems may overlook, simplifying financial management even in the busiest of times.

Introduction

Setting the Stage for Bookkeeping

Bookkeeping is often viewed as the backbone of any successful business, yet its intricacies can be daunting, especially for new entrepreneurs. Imagine waking up in the middle of the night, your mind racing with concerns about financial transactions and tax obligations. This scenario could be a reality for many business owners who overlook the significance of organized record-keeping.

In this digital age, the fundamentals of bookkeeping have evolved, but the core concepts remain essential. Here are a few critical aspects to consider:

- Accuracy: Beyond numbers, accuracy builds trust.

- Organization: A well-organized system makes it easier to retrieve information.

- Financial Insights: Clear records provide insights into your business’s performance.

In the coming sections, we will delve deeper into the fundamentals of bookkeeping, explore various types, and uncover the importance of maintaining robust financial records for a thriving business.

Fundamentals of Bookkeeping

Understanding the Basics

As we dive into the fundamentals of bookkeeping, it’s essential to grasp the core principles that underpin this vital practice. At its heart, bookkeeping is all about tracking financial transactions and maintaining accurate records. Think of it as the roadmap for your business’s financial journey.

Here are some key principles that define effective bookkeeping:

- Double-Entry System: Every transaction affects at least two accounts, ensuring a balanced ledger. This method reduces errors and provides a complete picture.

- Chart of Accounts: This is a systematic listing of all accounts used in the financial transaction records. It includes assets, liabilities, equity, revenues, and expenses.

- Consistency: Maintaining a consistent approach to recording transactions ensures clarity and reliability, making it easier to analyze financial performance over time.

Understanding these fundamentals not only lays the groundwork for effective bookkeeping but also empowers business owners to make informed financial decisions as we explore various types of bookkeeping in the next section.

-resize.jpg?token=14a9950ee98412bf6e7bcfc80420f0cf)

Types of Bookkeeping

Diverse Approaches to Keeping Records

Building on the foundational concepts of bookkeeping, it’s crucial to explore the various types that cater to different business needs. Each approach serves unique purposes and can significantly impact how financial data is recorded and analyzed.

Two primary types of bookkeeping include:

- Single-Entry Bookkeeping: This method records each transaction once, typically in a cash book, making it simple and straightforward. It’s often suitable for small businesses and freelancers who do not have complex financial situations. For instance, a local bakery may utilize this method to track sales and expenses efficiently.

- Double-Entry Bookkeeping: As mentioned earlier, this method involves recording each transaction in two accounts, maintaining the fundamental accounting equation (Assets = Liabilities + Equity). It’s favored by larger businesses due to its accuracy and comprehensive nature, allowing for better tracking of financial health.

Choosing the right type of bookkeeping is crucial for ensuring that your business remains organized and financially informed. In the next section, we’ll dive into the bookkeeping process that brings these types into action.

Bookkeeping Process

Steps to Effective Financial Management

Now that we’ve covered the different types of bookkeeping, it’s essential to understand the process that makes it all come together. The bookkeeping process involves a series of systematic steps designed to ensure accuracy and organization in financial record-keeping.

Here’s a straightforward breakdown of the typical bookkeeping process:

- Transaction Recording: Every financial transaction, whether a sale, expense, or payment, needs to be documented promptly. For example, a freelance graphic designer should log each client payment immediately to avoid confusion later.

- Journaling: After recording transactions, bookkeepers transfer them into journals. This includes categorizing the entries, making it easier to analyze specific areas of the business.

- Posting to Ledger: Transactions are posted from journals to the general ledger, where all accounts are maintained. This makes it simpler to generate financial statements later.

- Trial Balance: Regularly, a trial balance is created to ensure that debits and credits match, which helps identify any discrepancies that may have occurred.

- Financial Reporting: Finally, financial reports such as balance sheets and income statements are generated to provide insights into the business’s financial health.

By following these steps, business owners can maintain a clear financial overview and make informed decisions. In the upcoming section, we’ll explore the tools and software that can streamline this bookkeeping process.

Bookkeeping Tools and Software

Enhancing Efficiency with Technology

Following the structured bookkeeping process, utilizing the right tools and software can greatly enhance efficiency and accuracy in managing financial records. Today’s technology offers a plethora of options designed to simplify bookkeeping tasks and minimize errors.

Here are some popular types of bookkeeping tools:

- Cloud-Based Software: Platforms like QuickBooks and Xero allow users to access their financial data from anywhere, making it ideal for small business owners on the go. For example, a small coffee shop owner can enter sales data from their smartphone while managing operations.

- Spreadsheets: For individuals or businesses just starting out, traditional spreadsheet applications like Microsoft Excel or Google Sheets can be sufficient. They offer customizable templates for organizing transactions, although they may require manual calculations.

- Accounting Software: For more comprehensive needs, accounting software like FreshBooks or Wave includes features like invoicing, expense tracking, and report generation. These tools automate many aspects of bookkeeping, freeing up time for business owners to focus on growth.

Adopting the right tools can significantly streamline the bookkeeping process. Up next, we’ll delve into the importance of bookkeeping for businesses and how it can affect their overall success.