Introduction

Definition of Bookkeeping

Bookkeeping can be defined as the systematic recording and organizing of financial transactions for a business. This essential practice involves detailing every expenditure, income, and financial activity, ensuring that businesses maintain a precise account of their financial health. At its core, bookkeeping provides the foundation for future financial analysis and decision-making. Imagine a small business owner diligently tracking every sale and expense; this meticulous attention to detail allows them to understand their cash flow, which is critical for sustaining operations and fostering growth.

Purpose of Bookkeeping Terms Glossary

Understanding bookkeeping is not just for accountants; it’s invaluable for all business owners. Here’s why having a glossary of bookkeeping terms is beneficial:

- Clarity on Financial Concepts: Knowing common terms enables clearer communication, especially when discussing finances with accountants or advisors.

- Confident Decision-Making: With a solid grasp of terminology, business owners can make informed choices about budgeting, investments, and expenditures.

- Enhanced Record-Keeping: Familiarity with specific terms helps business owners maintain organized records, paves the way for compliance during audits, and simplifies tax preparation.

Just as learning a new language can open doors to fresh experiences, mastering bookkeeping terminology can empower business owners to take charge of their financial landscape.

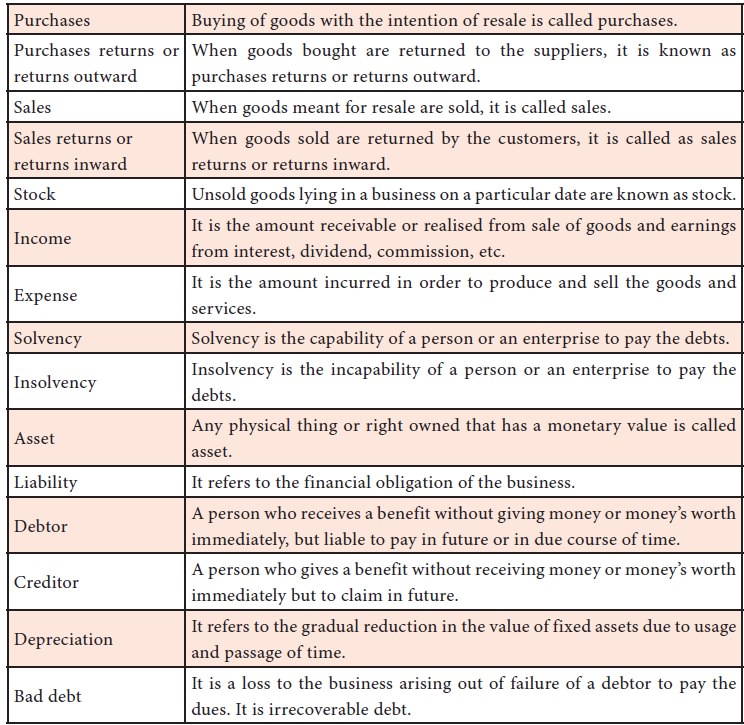

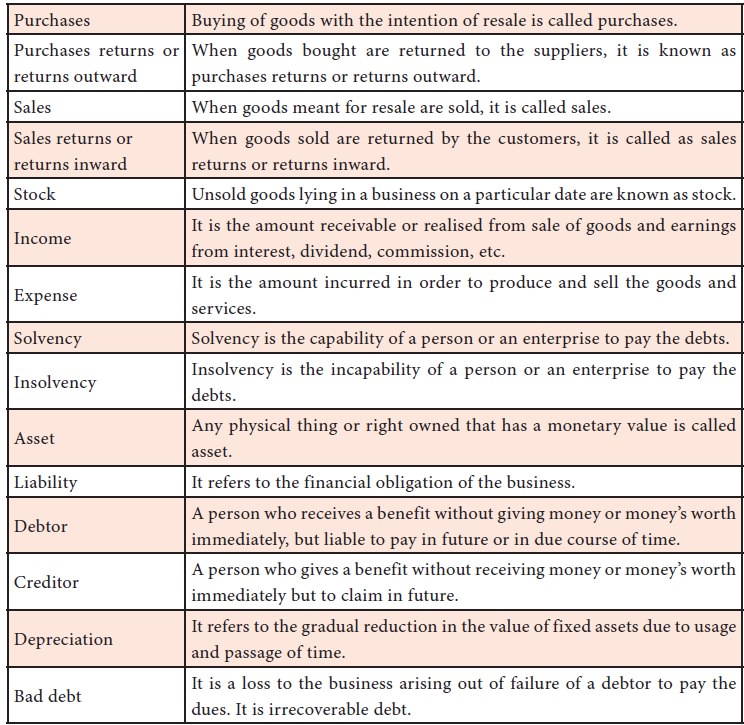

Basic Bookkeeping Terminology

Assets and Liabilities

In bookkeeping, understanding the balance between assets and liabilities is crucial. Assets are anything of value owned by a business, such as cash, inventory, or equipment. For instance, if a small bakery owns ovens and stockpiles flour, those are considered assets contributing to its operational capacity.

On the flip side, liabilities refer to what the business owes, including loans, accounts payable, or any financial obligations. Think of it this way: if that same bakery has borrowed money to purchase a new mixer, that loan represents a liability on its balance sheet.

Debits and Credits

Debits and credits form the backbone of double-entry bookkeeping. Each transaction impacts at least two accounts, maintaining the accounting equation. Here’s a simple breakdown:

- Debit: Increases an asset or expense account or decreases a liability or equity account.

- Credit: Decreases an asset or expense account or increases a liability or equity account.

Imagine a scenario where a company sells a product. It would record a debit to its cash account (increasing assets) and a credit to its revenue account (increasing equity). This dual approach ensures that the books remain balanced.

Revenue and Expenses

Revenue is the income generated from sales, while expenses are the costs incurred in the process of earning that revenue. For example, if a freelance graphic designer charges clients for projects, those payments constitute revenue. However, software subscriptions and office supplies needed to complete those projects represent expenses. Balancing revenue and expenses is vital for profitability and overall business sustainability.

Advanced Bookkeeping Terminology

Accrual vs. Cash Basis Accounting

When it comes to bookkeeping, one of the major distinctions lies in accounting methods: accrual and cash basis. In accrual accounting, revenues and expenses are recorded when they are earned or incurred, regardless of when cash changes hands. For example, if a service is rendered in December but paid in January, it still gets recorded in December’s accounting records.

Conversely, cash basis accounting captures transactions only when cash is received or paid, making it simpler but less reflective of a company’s financial standing. Imagine a freelance consultant who receives payment in February for a project completed in January; under cash basis, the income wouldn’t be recorded until February.

Trial Balance

A trial balance is an essential tool used to ensure that the totals of all debits and credits in the accounting records are equal. This serves as a preliminary check for accuracy before proceeding to prepare financial statements. By listing all account balances, a business can quickly identify any discrepancies. For instance, if a small business’s trial balance shows an imbalance, it prompts further examination to identify the source of the error, preventing potential misstatements in final reports.

Depreciation

Depreciation reflects the gradual decrease in value of tangible assets over time. Businesses commonly encounter this with equipment or buildings. For example, if a company invests in machinery costing $10,000 with a useful life of five years, it doesn’t expense the entire amount at once. Instead, it spreads the cost over the asset’s lifespan, allowing for a more accurate representation of profit by matching expenses with generated revenue. This method not only provides more realistic financial data but also benefits tax calculations.

Commonly Used Bookkeeping Abbreviations

GAAP

One of the most crucial acronyms in the realm of bookkeeping is GAAP, which stands for Generally Accepted Accounting Principles. These are a set of rules and standards that guide financial reporting in the United States. For business owners, understanding and following GAAP is paramount as it ensures consistency, transparency, and accuracy in financial statements. For instance, when preparing financial reports for investors or lenders, adhering to GAAP can enhance credibility and build trust.

FIFO and LIFO

Another pair of commonly used abbreviations are FIFO (First In, First Out) and LIFO (Last In, First Out), both of which pertain to inventory valuation methods.

- FIFO: This method assumes that the oldest inventory is sold first. For example, if a bakery uses FIFO, the oldest batch of bread will be sold before the newer batch, which can be beneficial for perishable goods.

- LIFO: In contrast, LIFO assumes that the most recently acquired inventory is sold first. This can have tax implications, especially in times of inflation.

By choosing the right method, businesses can significantly impact their taxable income and profitability.

P&L Statement

Lastly, the P&L statement, which stands for Profit and Loss Statement, is a financial report showing a company’s revenues and expenses over a specific period. This critical document allows business owners to assess profitability, monitor financial performance, and make informed strategic decisions. For instance, if a restaurant consistently sees lower profits during certain seasons, the owner can strategize on promotions or menu changes to enhance earnings. Understanding these abbreviations not only simplifies communication but also equips business owners with the knowledge to effectively manage their finances.

Bookkeeping Software Terminology

Cloud Accounting

As technology evolves, cloud accounting has become a buzzword in the bookkeeping landscape. Cloud accounting refers to the use of online software to manage financial data, allowing users to access their accounts from anywhere, anytime, as long as there’s an internet connection. This flexibility is particularly beneficial for small business owners juggling multiple tasks. For example, a retail store owner can check sales data from their smartphone while attending a family event, ensuring they’re always in the loop.

Some advantages of cloud accounting include:

- Automatic Updates: Software providers frequently update their systems, ensuring users benefit from the latest features.

- Scalability: As businesses grow, cloud accounting can easily scale up to accommodate increasing data and user needs.

Double-Entry Accounting

Double-entry accounting is a foundational concept in bookkeeping, ensuring every transaction affects at least two accounts. This method provides a complete picture of a company’s finances and helps maintain accurate records. For example, when purchasing inventory, the business records a debit in the inventory account and a credit in the cash account. This simultaneous recording minimizes errors and enhances data reliability, making it a vital practice for effective bookkeeping.

Chart of Accounts

Lastly, the Chart of Accounts (COA) is a pivotal tool for organizing financial information. It lists all accounts that a business uses to sort and categorize transactions, ranging from assets and liabilities to revenue and expenses. A well-structured COA not only simplifies record-keeping but also aids in generating insightful financial reports. Imagine a startup using clear account categories to track expenses; this clarity can significantly help in budgeting and forecasting, paving the way for informed business decisions.

Importance of Understanding Bookkeeping Terms

Benefits for Small Business Owners

Understanding bookkeeping terms is not just a nice-to-have for small business owners—it’s essential. A solid grasp of financial vocabulary can lead to better management of resources and operational efficiency. For instance, when owners can interpret balance sheets and profit and loss statements, they can identify trends and spot areas needing improvement, allowing them to act proactively rather than reactively.

Some key benefits include:

- Improved Communication: Being fluent in accounting language facilitates clearer discussions with accountants or financial advisors.

- Enhanced Cash Flow Management: Knowledge of terms like assets, liabilities, and net income helps owners keep track of cash flows, ensuring they can meet obligations and invest wisely.

Facilitating Financial Decision Making

Moreover, understanding these terms is vital for effective financial decision-making. When small business owners can analyze their financial health confidently, they are empowered to make choices that align with their goals. For example, if they understand depreciation, they can anticipate the impact on tax liabilities and budget for replacements more accurately.

By breaking down complex financial jargon, small business owners can:

- Identify Key Performance Indicators (KPIs): Recognize metrics that indicate business health.

- Make Informed Investments: Allocate resources more strategically, leading to potential growth.

In essence, a firm grasp of bookkeeping terms transforms business owners from passive participants in their finances to active, informed decision-makers.

Conclusion

Recap of Key Bookkeeping Terms

As we wrap up this exploration of bookkeeping terminology, it’s clear that mastering these terms offers significant advantages for business owners at all levels. We’ve covered essential concepts such as assets and liabilities, the foundations of accrual versus cash basis accounting, and the importance of double-entry accounting in maintaining organized financial records. Understanding terms like GAAP, FIFO, LIFO, and the P&L statement can pave the way for more informed business operations and strategic decision-making.

To recap, some of the key terms discussed include:

- Assets and Liabilities: Understanding what you own versus what you owe.

- Accrual vs. Cash Basis Accounting: The two schools of thought in recording income and expenses.

- P&L Statement: A critical tool for assessing profitability over time.

Encouragement for Further Learning

However, this is just the beginning. The world of bookkeeping and finance is vast, and continuous learning is vital in an ever-evolving business landscape. Consider taking online courses, reading books on personal finance, or joining workshops tailored to small business management. Engaging with a community of fellow entrepreneurs can also foster knowledge sharing and support.

Remember, the more you know, the better equipped you are to steer your business toward success. Embrace the journey of learning; it will undoubtedly pay dividends in your business’s future!